BRB Bottomline: In most cases we think of IPOs as moments when stocks are introduced in the market and report enormous returns. Do you believe a +94% on the first day of trading is just reflective of a firm’s fundamental value? Here, we provide our readers with some practical tools that may help investors to recognize overpricing.

An initial public offering (IPO) occurs when a private company lists a variable percentage of its shares on public markets for the first time. Companies will often turn to the stock market to raise equity financing because it represents a risk-averse way of getting capital as opposed to issuing debt and taking on financial leverage.

However, most IPOs present two characteristics that need to be further analyzed to raise awareness among investors. First, IPOs tend to experience positive first-day returns. This can be easily proved: considering the last 100 IPOs (going from November 19th backwards), the average first day return was 17.85%. However, IPOs, compared to seasoned securities, tend to have lower performances in the years following the offering, especially around the expiration of IPO lockup agreements.

Before going through a few examples of actual IPOs, we need to define two key terms that allow us to better unpack the nature of IPO pricing: short selling and lockup agreements. Short selling consists of the sale of a security that is borrowed by the seller. This practice is motivated by the belief that a security’s price will decline, enabling the original seller to buy it back at a lower price, return the borrowed stock, and make a profit. IPO lockup agreements are constraints imposed by the underwriter to keep pre-IPO shareholders from immediately selling their stock when the company raises public capital and usually last for 180 days after the IPO.

IPO Pricing From a Berkeley-Haas Distinguished Teaching Fellow

Berkeley-Haas Professor P. Patatoukas co-authored a paper that explains how two main factors combined make IPOs prone to experience overpricing.

First, the divergence of investors’ opinions about the company. A pronounced divergence is caused by high sales growth, negative profitability (operating loss) and above average intangible intensity. This combination makes it difficult for investors to forecast future cash flows to evaluate the company’s intrinsic value, therefore creating a wide diversity of opinions about assumptions of growth and profitability.

The second factor considered is IPO offering size, that is, the number of shares to be issued in an IPO. A small offering size, compared to the total numbers of shares outstanding in the company, makes it hard for potential short-sellers to borrow the stock. Here is where we connect the dots.

As long as lockup agreements don’t expire, short selling is constrained, reducing the downward pressure on the stock price caused by short positions. The first moment when short sellers can implement their strategy is when shares are available, which is when lockup agreements expire. When pre-IPO shareholders begin to sell their stock, those shares become publicly-available to short, which means short sellers also begin to sell. The double-effect leads, in most cases, IPOs to experience particularly negative performance around lockup expiration dates.

Real-Life Evidence

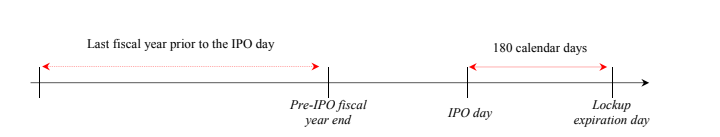

Data show that an ex-ante combination of high divergence of opinion and small offering size makes an IPO particularly prone to present the two characteristics mentioned at the outset. Here is the timeline investors must consider.

Recall the recent IPO of Elastic Inc (NYSE:ESTC), a software company that on Oct 4th, 2018 raised $193 million in its IPO. Between 2017 and 2018, i.e. in year-ending prior to the IPO, the company had a sales growth of 78%, operating losses of $47 million and R&D and advertising expense (intangible intensity) as high as 40% of revenues (here is Elastic’s Prospectus). These elements may ex-ante guarantee a high divergence of investors’ opinions. Moreover, Elastic only issued only 11% of their outstanding shares, which is a comparably small offering size.

Indeed, Elastic on IPO day recorded a +94% return (first characteristic); however, since its IPO, the company has lost 13.5% of its value (second characteristic). Beware, with this evidence, I am not implying that Elastic is surely overpriced, but I am highlighting that there are sufficiently concrete elements to consider this possibility.

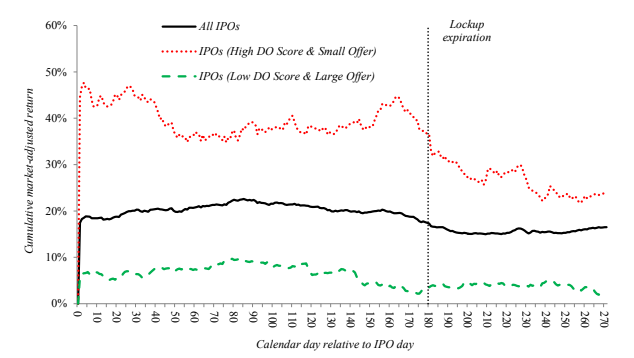

The research Professor Patatoukas and his co-authors pursued, based on a sample of 701 recent IPOs between 2007 and 2015, provided these striking results:

Looking at this chart, it can be noticed how IPOs characterized by high divergence of opinion and small offering size, the red dashed line in the chart, report above average returns on the first day of trading and a steep fall around lockup expiration date.

Although the outcome of this study looks unquestionable, there can be, as usual, exceptions. Take for instance MongoDB (NASDAQ:MDB), another software company that on Oct 19th, 2017 raised $192 million in its IPO. Analyzing again the company’s background, it turns out that MongoDB in the year prior to IPO reported a 61% sales growth, operating losses of $87 million and R&D and Adv expenses as high as 50% of revenues (MongoDB’s prospectus). In this case, the company offered in the IPO less than 10% of the shares outstanding, which is even less than in Elastic’s case.

However, even though on the first day of trade the stock reported a +34% performance, the price kept rising, even after its lockup expiration date. The stock is now up +222% from its IPO. Again, I don’t have any opinion on the correct valuation for MongoDB shares, but a proper way to read this situation may be to interpret that the pre-IPO shareholders’ decision on lockups expiration date to maintain their positions shows that they still expect the stock to continue its gains.

To get just a little out of the frame we considered up to now, following the guidelines we learned, let us examine the cryptocurrencies markets: it is easy to notice a natural analogy with all that has been discussed. Cryptocurrencies are hard to value, possibly implying high divergence of opinion, and, at the moment, they are quite difficult to short. Therefore, cryptocurrencies may also be a market environment that is prone to consistent overpricings. You can read more about these overpricings in an article written by BRB’s Senior Investing columnist, who calls these markets Financial Twilight Zones.

Take Home Points

Always consider the fundamentals of a company before investing in an incoming public offering, and specifically the features considered in this article. They are easy-to-find tools that have been proven to be determinant in the valuation of IPO. Usually, attracted by the hope of gigantic returns in the very short run, investors get excited for IPOs. Even if companies present good chances of future growth, the first months as public companies may lead the stock price to reflect unrealistic values. Beware, and consider what you read. As a retail investor, your best bet is probably to stay away from recently-listed stocks and wait for eventual adjustments. As Professor Patatoukas likes to say, investors may consider going from “the fear of missing out” to “the joy of missing out”.

Is it okay if I ask you to elaborate? Could you write an additional example? many thanks!